A client approached us seeking a property development loan with no pre-sales in Melbourne Victoria. He had purchased a development site in Melbourne’s Bentleigh East and was seeking a construction loan. There was plans & permits for the development of 4 town homes on the current site.

The client had approached several banks, with the consensus being that they could not assist or the loan would need to be a commercial loan at a high interest rate. Some lenders said that they may even require pre-sales.

Our client did not intend on selling the town homes and was seeking to build for rent. Build to rent is increasing in popularity especially in Melbourne, where clients are seeking to hold all townhouses/units and to receive rental income.

Loanbrite has a large selection of banks and non-banks, we look to tailor solutions in line with our customers requirements and needs.

In this instance we did not goto a non-bank private lender as the customer had enough borrowing capacity to go through a mainstream bank on a 30 year loan. Here is who it was structured:

Overall lending was at 80% LVR, a loan amount of $1.8mil was required. This final loan amount was reached will simply maths. $900k was required to refinance and payout the current loan on the old house, as the new bank will always require 1st mortgage and hold the title. Then a construction loan facility of $900k was setup. The construction loan secured against the fixed price build contract from a registered builder.

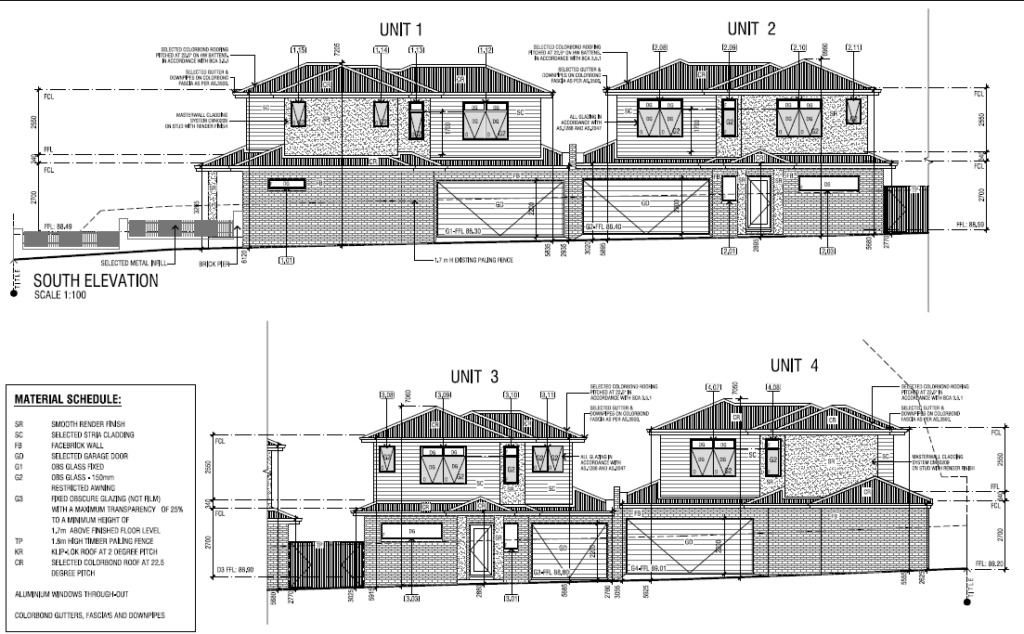

A copy of the FPBC (fixed price build contract), working drawings and specifications/inclusions list for the townhouses was all that was required at the initial stage. Their finance broker Loanbrite was then able to order what is referred to as an ‘on-completion in-line’ valuation. The valuation is referred to as ‘in-line’ valuation as subdivision has not occurred, hence the bank’s valuer provided a valuation with all 4 townhouses on the one title.

We were able to secure construction finance through a mainstream bank on a residential product. This met our clients needs as we were able to offer a 30 year investment loan, with no need for pre-sales and it was on a residential investment loan.

Given that this was a residential loan product we had to demonstrate that our client had enough borrowing capacity to “service” the loan – make the required loan repayments at the banks assessment rent. As the town homes were to be held as investments then the ‘proposed rental’ income was also used. This proposed rental income was provided on the valuation report.

It was a favourable outcome for our client. As they did not require pre-sales, the requirement was help finance the construction and to retain all the townhouses. Hence these requirements were fulfilled with the proposal of a residential loan product over 30 years on an investment loan rate.

FAQs:

Do I need to have pre-sales for development finance?

To avoid pre sales: Banks will require “servicing” to cover the debt from your trading business or income. Private non-bank lenders will not require pre-sales. Enquire now to find out more

What is a TOC/TBE/On competion valuation?

The valuer will use your current plans, build contract and inclusions list. Outlining the town homes dimensions and finish quality to determine the ‘upon completion’ valuation. TOC = “Tentative on Completion. TBE = “To be erected”.