Why the need for an Unsecured Business Loan

Every year in Australia 400,000 small and medium-sized businesses need cash flow finance, and usually the big banks can’t help.

No more providing endless financial information and pain-staking paperwork to fill. Your bank statements can be accessed all online within the application system. No need to photocopy or email documents. The entire application process can be completed online, approved in 24-48 hours, accepted online and transferred to your bank account.

About Loanbrite

We’re passionate about helping small businesses. Our Unsecured Business Loan customers come from many different industry sectors, but have two things in common:

• They need working capital quickly

• Traditional funding is too challenging for many reasons.

See some examples of past unsecured business loan scenarios that were approved.

Common uses for funds include bridging receivables gaps, purchasing inventory, building a new website, hiring more staff, renovating or expanding premises, purchasing equipment or paying ATO tax portal debt (some parameters apply).

Our law firm required $200k to start an IT systems upgrade and re-design of our website to be responsive and mobile-friendly. Our loan application was turned around within 48 hours and we commenced the project within the week

Our friendly team can help with:

• A simple online application process

• Loans of up to $250k

• Fast turnaround and high approval rates

• Most loans are approved in less than 24 hours*

• No security required

• Cash-flow friendly repayments.

Understanding the Unsecured Business Loan

We were trading strongly but didn’t have the liquidity to pay two big ATO debts at the same time. Due to the strong cash flow in our business the loan was approved within 24 hours

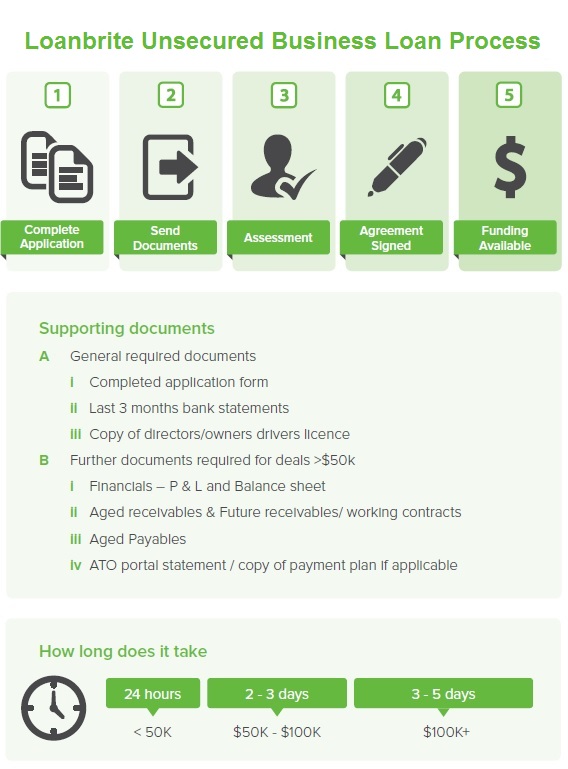

An unsecured business loan works on a fixed term of between 3 and 12 months, with daily or weekly repayments. It suits businesses with regular income (daily / weekly / monthly). Our minimum criteria includes income of >$5k per month and 12 months of trading history. For loans under $50k we only need photo ID and 3 months of bank statements. For loans over $50k we also need current account receivables, payables and other basic financials.

We don’t use annual interest rates because loan terms are usually less than 12 months with an ABN. We use a factor rate of between 1.15 and 1.4 depending on credit quality and term. To assess the cost of a loan, multiply the loan amount by the factor rate. For example, a loan of $10,000 would cost between $11,500 and $14,000.

Our factor rate includes all costs – there are no hidden fees and charges. We always disclose the total cost of the loan up front.

A big sponsor pulled out at the last minute. We couldn’t have held the conference without the business loan, and it was so critical to help us stimulate revenue growth in our franchise network. The process was quick and easy and they needed very little documentation

Why you may need a unsecured lend

How we can Help?

For this type of loan we do not require any security such as property, cars, invoices or debtors. We can finance up to $250,000 based on a businesses cashflow and performance.

| Traditional Funding | Customer Challenge |

|---|---|

| Equipment asset finance | Need help with deposit, has reached approval limit |

| Factoring | No invoice, or cannot get debtors approved |

| Bank loan | Customer does not own property or does not wish to use family home as security |

| Second mortgage | Customer LVR is too high |

| Overdraft | Customer cannot provide security or has reached limit |

Try us – we’re easier & friendlier than your Bank! You can use the money for any need such as renovations, marketing, inventory, expansion or general working capital.

Why use us for your next Business Loan?

|

We provide 24 hour approval and funds within 3 days*.

No application fees Minimal Documentation Required Use for any business need No Security Required Cashflow friendly Easy renewal & ongoing access to funds |

We’ve simplified the process. Apply online in only minutes, without the painful paperwork or waiting in queues. Get approved and start growing your business today.

Have one of our Business Loan specialist’s call you to see if you are a fit for this product or to explore different options:

We’ve made unsecured business lending easy and fast. Simply click the apply button above and complete the online form. All you need to have ready is your driver’s licence number and your business ABN. You can choose to allow us to use an advanced bank verification system link to instantly verify your bank information online. In the case please have you bank account information with you. Alternatively, you can choose to upload copies of your bank statements please make sure you have three months of statements as PDF documents ready to upload. These can be downloaded from your bank’s internet banking service.

Don’t worry its safe to link to banking details to the online system. The secure server is compliant with all applicable Australian quality and security standards. All your personal, sensitive and financial data are also encrypted. An advanced bank verification system link is used to instantly verify your bank account information online so we can provide a fast response.

Application is 100% online and funds can usually be provided the same business day. Traditional business loans reference an interest rate per annum plus other fees and charges. The Unsecured Business Loan details the total amount payable upfront inclusive of any interest, fees or charges that is then broken down into either a daily or weekly repayment figure.

A response can usually be provided in one hour if you apply during standard business hours and use the advanced bank verification system link to instantly verify your bank information online. If you choose to upload copies of your bank statements then a decision can be made in one day.

We are passionate about small business and know how important it is to grow your business, we will work hard to get money to you as soon as possible. If you apply before 4pm on a business day and you application is approved, we can usually have money in your account the same business day.

There are no fees for early repayment and no balloon payment at the end of your loan. We are totally transparent with our customers about the total amount due and the date of the final payment. Once you make the final payment your balance will be $0.

*Subject to credit approval. Terms and conditions apply, contact us for details.