Does your SME have an outstanding business debt or ATO tax debt?

We can refinance business debt up to 80% LVR (loan to value ratio) at residential home loan rates. Cash out for working capital is acceptable up to 80% LVR at residential rates. You can also purchase a business/commercial building with a residential dwelling as a security at up to 80% LVR all at residential rates.

See the benefits below:

- Home Loan interest rates instead of business or commercial rates

- Reduced cash flow burden from business

- One application form and only home loan application fees

- One set of loan documents

- No fixed and floating charge or debentures over the business

- No cross guarantees required

- No annual reviews

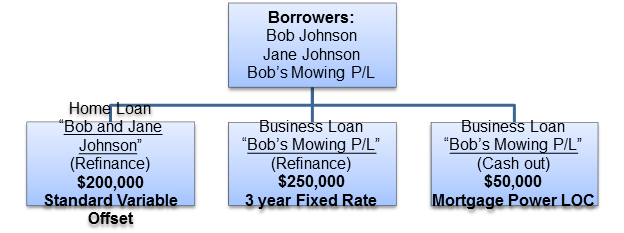

Each loan split can be in a number of names, making it very easy for accounting purposes to know which loan relates to which entity. Statements, and if applicable, cheque books and cards, would also be styled the same way.

We can structure the loans so that the individuals and company are co-borrowers, eliminating the need for guarantees.

If you are in need of pure commercial facility you can find more information on commercial property loans.

Please contact us to find out further information and help you with your refinancing needs.